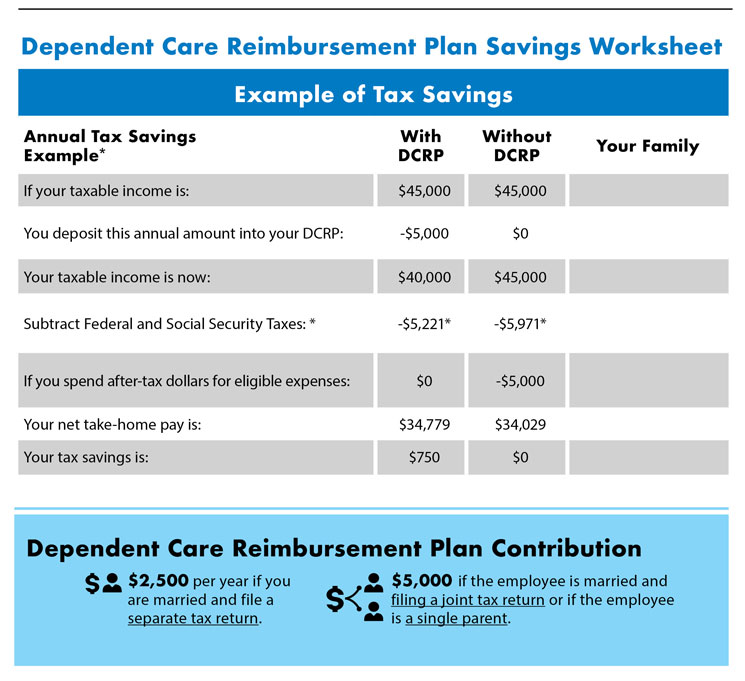

Because of the american rescue plan signed into law in march 2025, the contribution limit has been raised to $5,500 for married couples filing jointly or $2,750 for. If the fsa plan allows unused fsa.

Here are the new 2025 limits compared to 2025: In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

Family members benefiting from the fsa have individual limits, allowing a married couple with separate fsas to each contribute up to $3,200, subject to employer.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). Fsas only have one limit for individual and family health.

Fsa Limits 2025 Dependent Care Tera Abagail, And when filling out line two, be aware of the current contribution limits. Those 55 and older can.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, For 2025, reimbursements under a qsehra cannot exceed $6,150 (single) / $12,450 (family), an increase of $300 (single) / $650 (family) from 2025. Here are the new 2025 limits compared to 2025:

Irs Fsa Max 2025 Joan Ronica, The fsa maximum contribution is the. How do fsa contribution and rollover limits work?

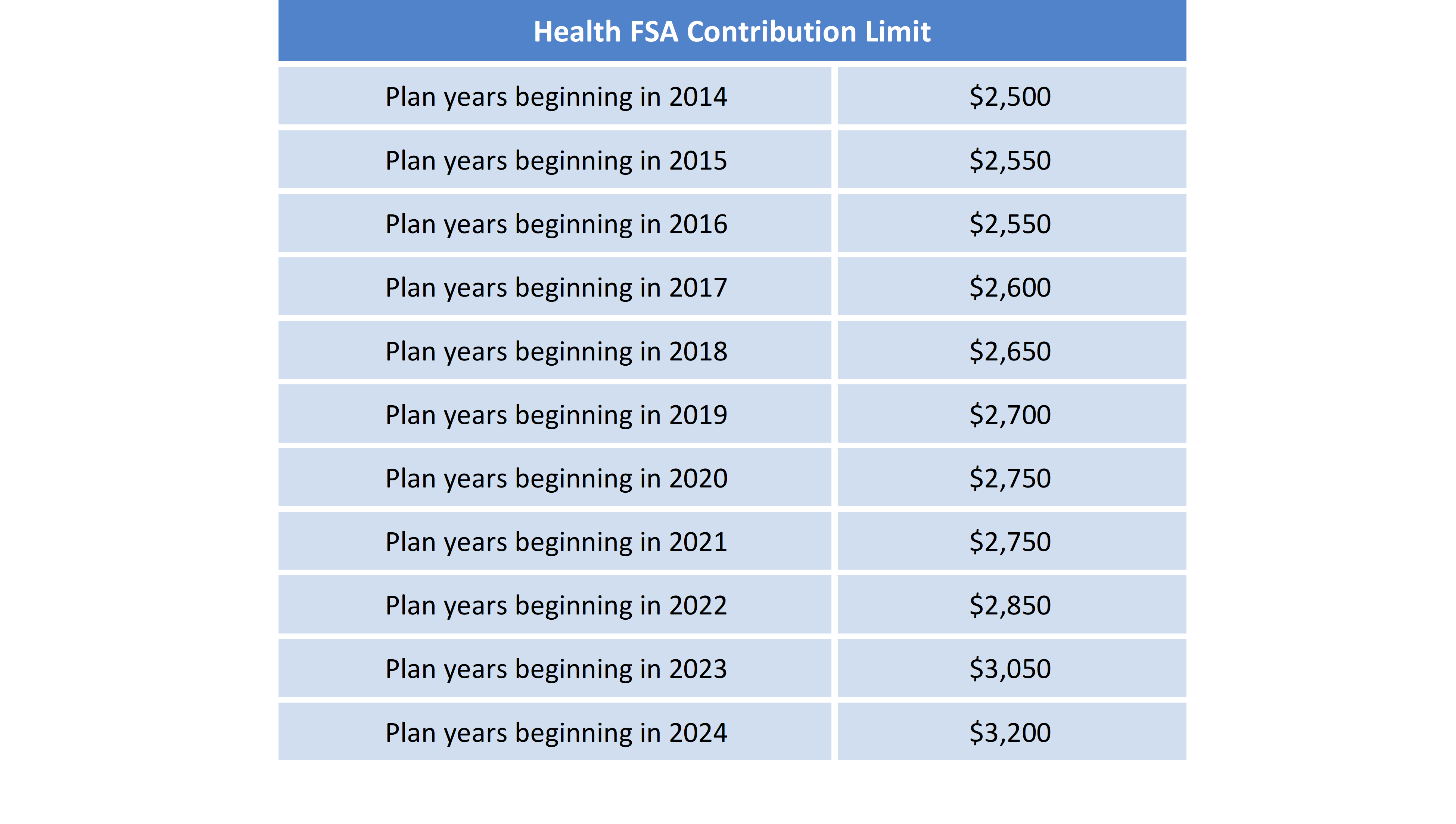

2025 Contribution Limits For The TSP, FSA & HSA YouTube, This limit started as $2,500 for. On november 9, 2025, the irs released the 2025 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.

What Is The Fsa Limit For 2025 2025 JWG, If the fsa plan allows unused fsa. An fsa contribution limit is the maximum amount you can set.

Health Care FSAFEDS Contribution Limits Increase for 2025, What is the 2025 maximum fsa contribution? Those limits rose to $3050, and in the 2025 plan.

FSAHSA Contribution Limits for 2025, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). Those limits rose to $3050, and in the 2025 plan.

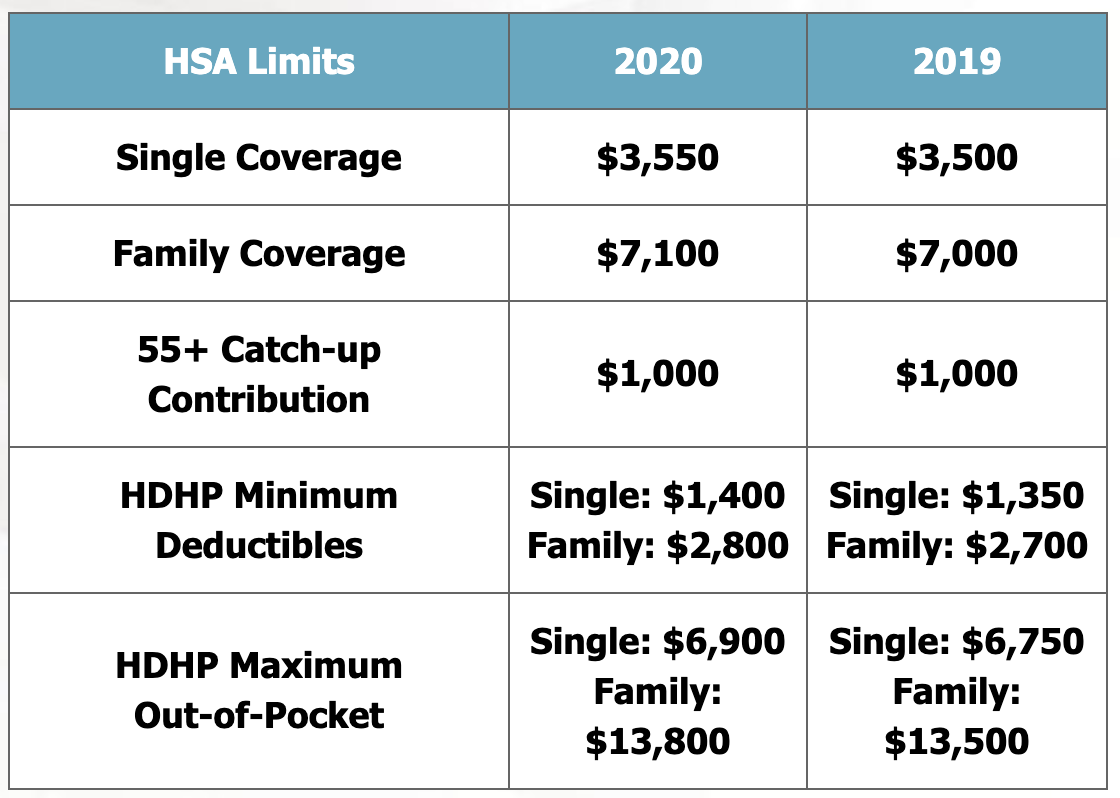

Hsa Family Contribution Limit 2025 Riva Verine, Fsas only have one limit for individual and family health. For 2025, reimbursements under a qsehra cannot exceed $6,150 (single) / $12,450 (family), an increase of $300 (single) / $650 (family) from 2025.

2025 Vs 2025 Hsa Contribution Limits Lynne Rosalie, An fsa contribution limit is the maximum amount you can set. How do fsa contribution and rollover limits work?

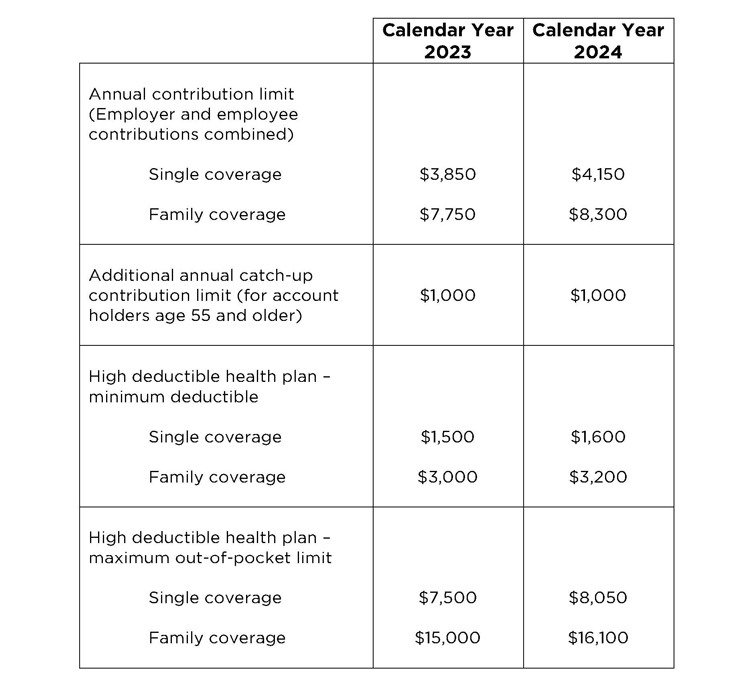

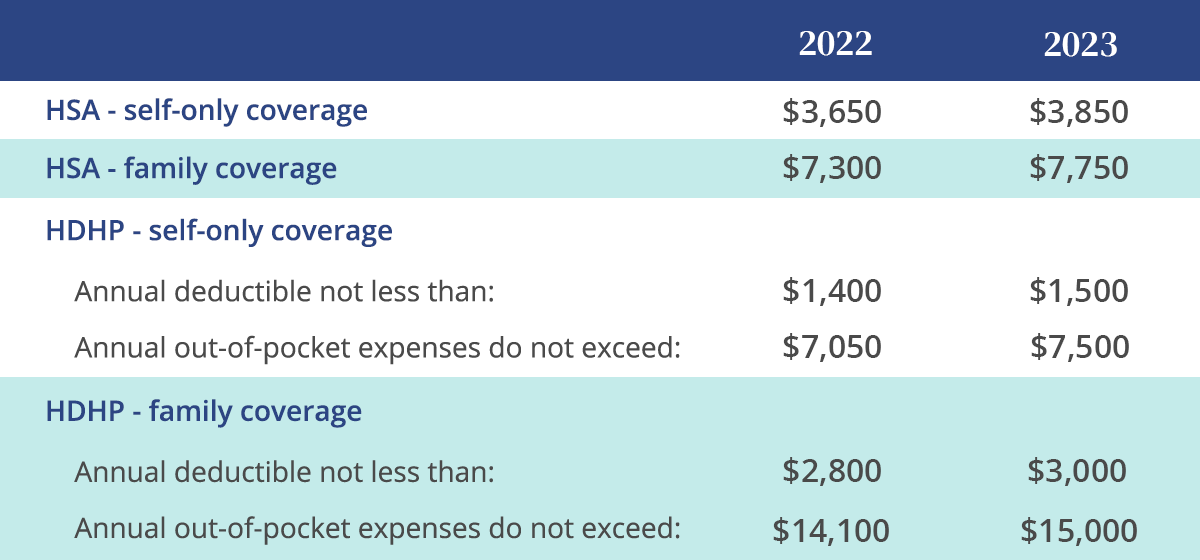

The contribution limit for individuals is set at $4,150, a significant increase from the 2025 limit of $3,850.